POLICY REVIEW

Did you know that more than 60% of people that own life insurance have no idea what they own and how it works? By offering life insurance reviews to

your clients you can provide a value-add service to them that will help them understand what they have and potentially uncover new opportunities.

POLICY REVIEW

NEXT STEPS

1

OFFER IT TO YOUR CLIENTS

Download this client-facing piece that explains to your clients the importance of Policy Review and why it is important. You can also request it be personalized with your information as well.

2

CLIENT COMPLETES AUTHORIZATION

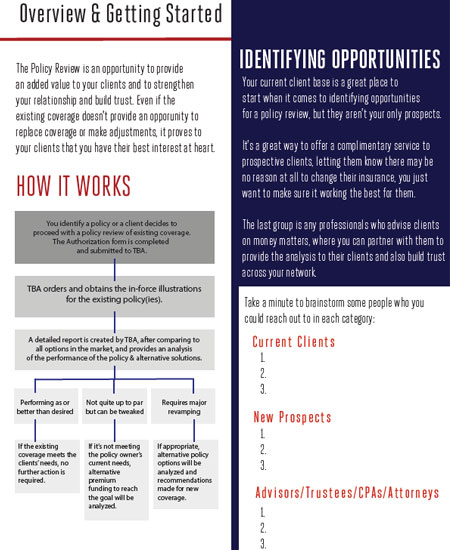

Use the authorization form to get all information on your client’s existing policy – regardless if written by you – and send it to your TBA representative so we can request an inforce illustration.

3

TBA PROVIDES YOU WITH RESULTS

Once the inforce illustration has been received, our team will compare it with the current market and provide you with an easy-to-read analysis. This will determine whether the client

should pursue new coverage or what they have is working.

LISTEN TO WHY

Zach Gosselin, Vice President & Sales for TBA, talks you through how to capitalize on an opportunity when a client has a life insurance policy that you didn’t write. Even if it doesn’t put you in a position to write new coverage, it may build important trust with the client about your knowledge and expertise as their advisor.

OVERVIEW

CASE STUDY

BE THE EXPERT YOUR CLIENTS SEEK

We will support you as you offer important complimentary services to existing and potential clients

in order to position yourself as a trusted advisor in regards to their financial planning.